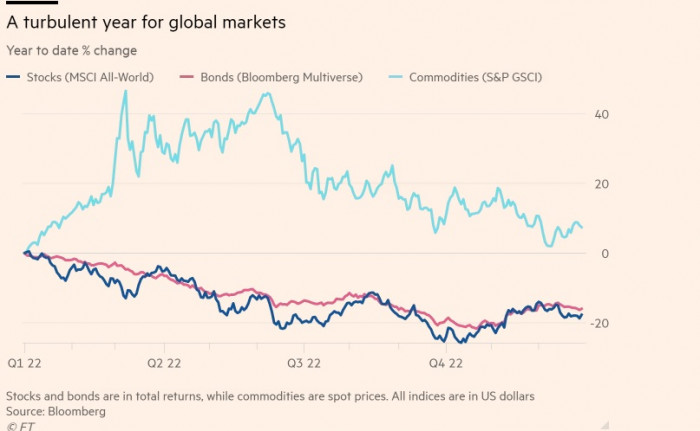

FT: Global stock exchanges and bond markets lost more than $30 trillion in 2022

Global stock exchanges and bond markets lost more than $30 trillion in 2022, the largest amount since the global financial crisis of 2008. This was reported by the British newspaper Financial Times. According to the newspaper, the main reasons for the losses were high inflation in many Western countries, rising interest rates and the effects of the conflict in Ukraine. The newspaper drew attention to the fact that the broad index of developed and emerging market stocks MSCI All-World this year lost a fifth of its value, the biggest fall since 2008. At the same time, stocks in New York, Shanghai and Frankfurt-am-Main have all slumped significantly. In particular, the S&P 500 index lost almost 20% and the Nasdaq electronic exchange index dropped 33%, its worst result since 2008. The CSI 300 index in Shanghai and Shenzhen fell 22% in local currency terms and 28% in dollar terms. The MSCI Europe Index was down 16% in dollar terms and 11% in euro terms.  |

Entry and exit restored for cargo transport between Azerbaijan and Iran

18111:18

Iran war spreading economic damage far beyond oil and gas markets

363Yesterday, 18:02

Speaking of the strategic Strait of Hormuz, Araghchi said, "We have no intention to close it right now."

57805.03.2026, 23:06

Next batch of petroleum products dispatched from Azerbaijan to Armenia (video)

52505.03.2026, 12:42

EU extends sanctions against Russia until February 24, 2027

57523.02.2026, 17:30

Trump ends some tariffs, imposes new 10% global one

69221.02.2026, 12:12